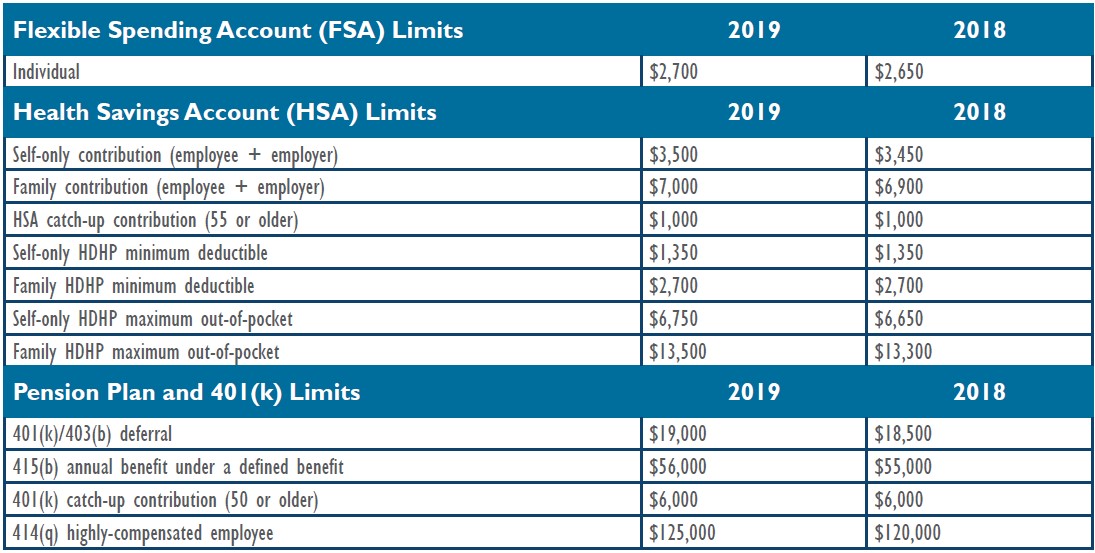

2025 Fsa Contribution Limits Irs Increase. Here, a primer on how fsas work and why they are an essential way. Limits for employee contributions to 401(k), 403(b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2%.

The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. An employee who chooses to participate in an fsa can contribute up to $3,200 through.

IRS Announces 2025 Increases to FSA Contribution Limits SEHP News, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

Irs Fsa Contribution Limits 2025 Paige Rosabelle, 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200.

2025 Irs Fsa Contribution Limits Issi Rhetta, As health plan sponsors navigate the open enrollment season, it’s important that employees are made aware of the adjusted limits as they update their enrollment.

2025 Fsa Contribution Limits Family Lydie Romonda, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

2025 Fsa Limits Increase Lenna Marrissa, Family members benefiting from the fsa have individual limits, allowing a.

Irs Fsa Contribution Increase 2025 Shela Annabella, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

2025 Fsa Maximum Contribution Increase Per Year Ebba Neille, If the fsa plan allows unused fsa.

.png)