Income Tax 2025 Philippines Calculator. Subtracting the total contributions of ₱1,825 (₱1,125. Also, start saving today with our pag.

A quick and efficient way to compare annual salaries in philippines in 2025, review income tax deductions for annual income in philippines and estimate your 2025 tax returns for. The application is simply an automated.

How To Compute Tax In The Philippines Free Calculator APAC, Find your net pay : The application is not downloadable.

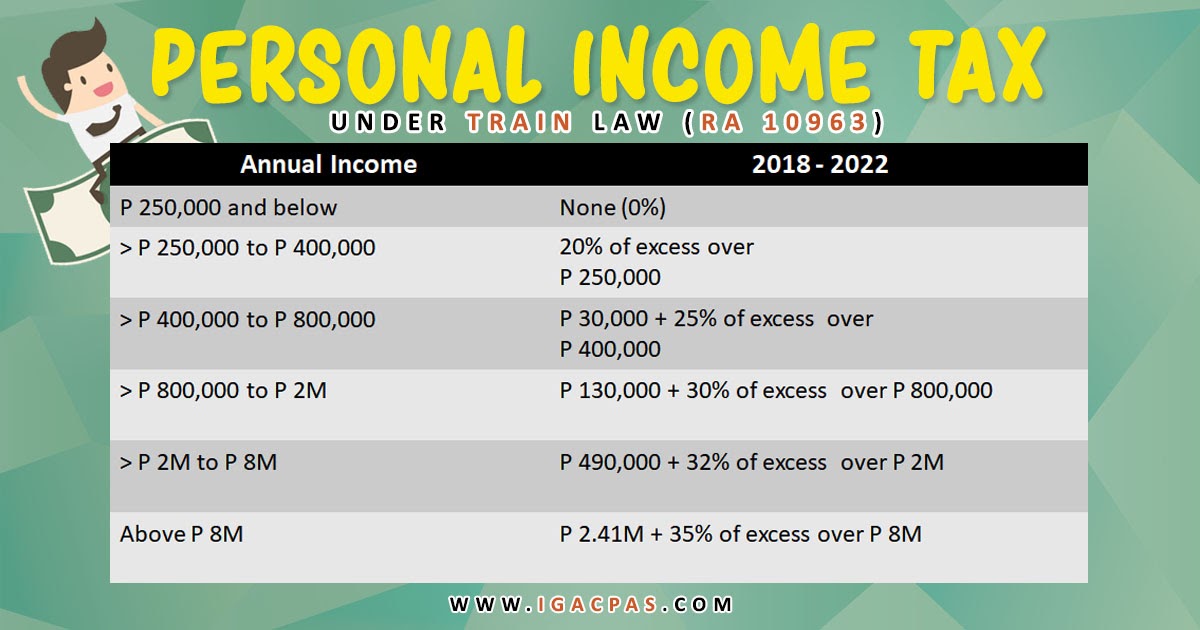

Taxes Applicable to SoleProprietors, Freelancers, SelfEmployed and, A comprehensive suite of free income tax calculators for philippines, each tailored to a specific tax year. Apply the tax rate from the income tax table to your taxable income.

Tax Refund 2025 23 Timeline TAX, A quick and efficient way to compare annual salaries in philippines in 2025, review income tax deductions for annual income in philippines and estimate your 2025 tax returns for. That means that your net pay will be ₱ 83,956 per year, or ₱ 6,996 per month.

Tax rates for the 2025 year of assessment Just One Lap, Just enter your gross monthly income using the latest bir, sss, hdmf, and philhealth tables. You just need to enter your monthly income and then use the calculator to compute your taxable income, monthly tax due, and net.

Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax, The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in philippines. If you make ₱ 90,000 a year living in philippines, you will be taxed ₱ 6,044.

![Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png)

Tax Calculator For FY 202021 [AY 202122] Excel Download, Philippines income tax calculator for 2025 tax year; Enter your employment income into our salary calculator above to estimate how taxes in the philippines may affect your finances.

![Tax Calculator For FY 202021 [AY 202122] Excel Download](https://www.apnaplan.com/wp-content/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22-1024x547.png)

BIR Personal Tax Calculator Philippines 2025, That means that your net pay will be ₱ 191,183 per year, or ₱ 15,932 per month. Just enter your gross monthly income using the latest bir, sss, hdmf, and philhealth tables.

12,999 a month after taxes in British Columbia in 2025, The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in philippines. We get that value by:

Tax Return Calendar 2025 Get Calender 2025 Update, You just need to enter your monthly income and then use the calculator to compute your taxable income, monthly tax due, and net. Enter your employment income into our salary calculator above to estimate how taxes in the philippines may affect your finances.

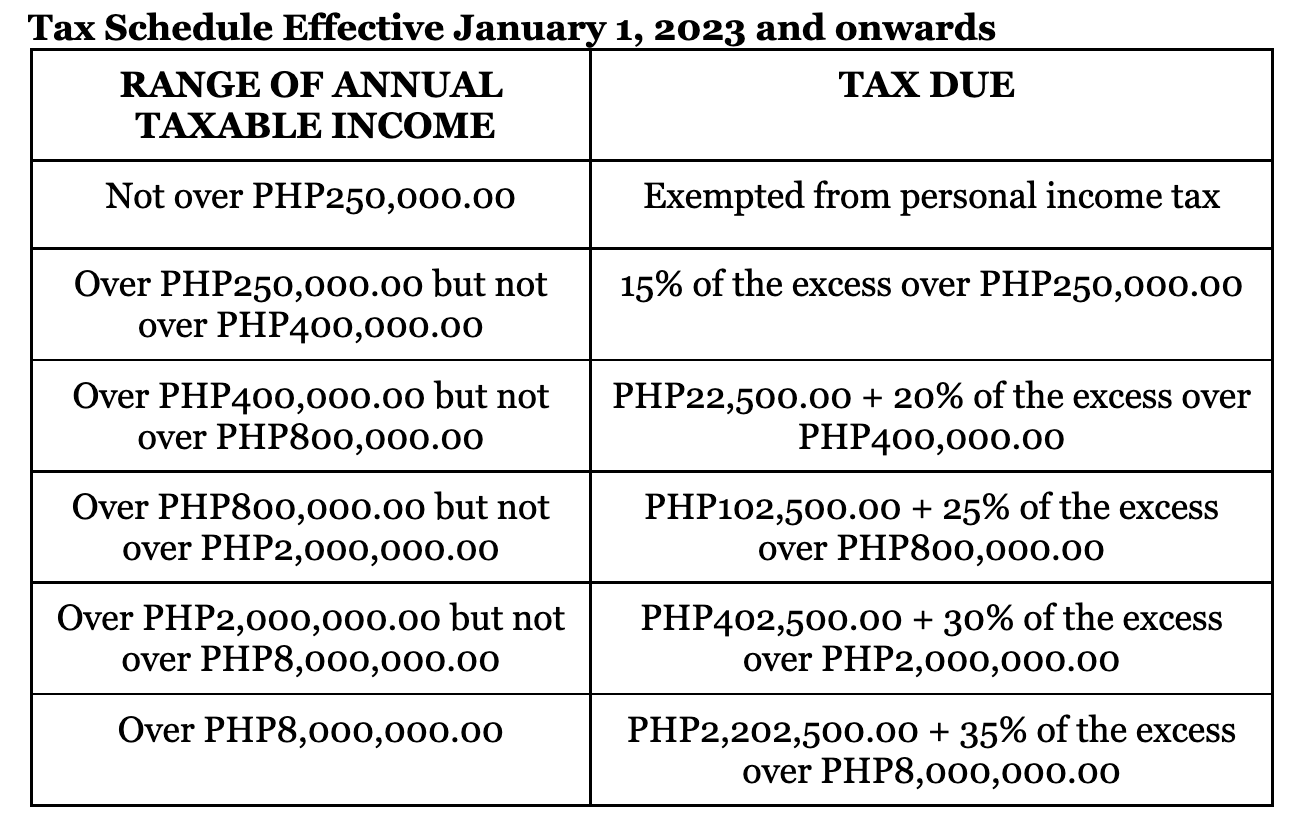

BIR Tax Schedule Effective January 1 2025, A quick and efficient way to compare annual salaries in philippines in 2025, review income tax deductions for annual income in philippines and estimate your 2025 tax returns for. Philippines income tax calculator for 2025 tax year;

Use our philippines payroll calculator for the 2025 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions.